16.8.2009 | 21:26

Iceland and Latvia can’t pay, so they won’t

Á nćstu dögum mun liggja fyrir íslensk ţýđing á greininni sem verđur ađgengileg víđa.

Iceland’s debt repayment limits will spread

by Michael Hudson

Can Iceland and Latvia pay the foreign debts run up by a fairly narrow layer of their population? The European Union and International Monetary Fund have told them to replace private debts with public obligations, and to pay by raising taxes, slashing public spending and obliging citizens to deplete their savings.

Resentment is growing not only toward those who ran up the debts – Iceland’s bankrupt Kaupthing and Landsbanki with its Icesave accounts, and heavily-geared property owners and privatisers in the Baltics and central Europe – but also toward the foreign creditors who pressured these governments to sell off the banks and public infrastructure to insiders.

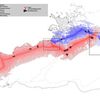

Support in Iceland for joining the EU has fallen to just over a third of the population, while Latvia’s Harmony Centre party, the first since independence to include a large segment of the Russian-speaking population, has gained a majority in Riga and is becoming the most popular national party. Popular protests in both countries have triggered rising political pressure to limit the debt burden to a reasonable ability to pay.

This political pressure came to a head over the weekend in Reykjavik’s Parliament. The Althing agreed a deal, expected to be formalised today, which would severely restrict payments to the UK and Netherlands in compensation for their cost in bailing out their domestic Icesave depositors.

This agreement is, so far as I am aware, the first since the 1920s to subordinate foreign debt to the country’s ability to pay. Iceland’s payments will be limited to 6 per cent of growth in gross domestic product as of 2008. If creditors take actions that stifle the Icelandic economy with austerity and if emigration continues at current rates to escape from the debt-ridden economy, there will be no growth and they will not get paid.

A similar problem was debated 80 years ago over Germany’s World War I reparations. But many policymakers remain confused over the distinction between squeezing out a domestic fiscal surplus and the ability to pay foreign debts. No matter how much a government may tax its economy, there is a problem turning the money into foreign currency. As John Maynard Keynes explained, unless debtor countries can export more, they must pay either by borrowing or by selling off domestic assets. Iceland today has rejected these self-destructive policies.

There is a limit to how much foreign payment an economy can make. Higher domestic taxes do not mean that a government can translate this revenue into foreign exchange. This reality is reflected in Iceland’s position on its Icesave debt – estimated to amount to half its entire GDP. And in taking this stand, Iceland promises to be merely the first economy to lead the pendulum swing away from the ideology that debt repayments are sacred.

In the post-Soviet economies the problem is that independence in 1991 did not bring the hoped-for western living standards. Like Iceland, they remain dependent on imports. Their trade deficits have been financed by the global property bubble – borrowing in foreign currency against property that was free of debt at the time of independence. Now the bubble has burst, and it is payback time. No more credit is flowing to the Baltics from Swedish banks, to Hungary from Austrian banks, or to Iceland from Britain and the Netherlands. Unemployment is rising and governments are slashing healthcare and education budgets. The resulting economic shrinkage is leaving large swaths of property in negative equity.

Austerity programmes were common in third world countries from the 1970s to the 1990s, but European democracies have little tolerance for such an approach. As matters stand, families are losing their homes and emigration is accelerating. This is not what capitalism promised.

Populations are asking not only whether debts should be paid, but – as in Iceland – whether they can be paid. If they cannot be, then trying to pay will only shrink economies further, stopping them becoming viable.

Will Britain and the Netherlands accept Iceland’s condition? Trying to squeeze out more debt service than a country could pay requires an oppressive and extractive fiscal and financial regime, Keynes warned, which in turn would inspire a nationalistic political reaction to break free of creditor-nation demands. This is what happened in the 1920s when Germany’s economy was wrecked by the rigid ideology of the sanctity of debt.

A pragmatic economic principle is at work: a debt that cannot be paid, won’t be. What remains an open question is just how these debts won’t be paid. Will many be written off? Or will Iceland, Latvia and other debtors be plunged into austerity in an attempt to squeeze out an economic surplus to avoid default?

The latter option may drive debt-laden countries in a new direction. Eva Joly, the French prosecutor brought in to sort out Iceland’s banking crisis, warned this month that Iceland would have little left but its natural resources and strategic position: “Russia, for example, might well find it attractive.” The post-Soviet countries are already seeing voters shift away from Europe in reaction to the destructive policies the EU has been supporting.

Something has to give. Will rigid ideology give way to economic reality, or the other way round?

The writer is professor of economics at the University of Missouri

Flokkur: Stjórnmál og samfélag | Facebook

Tenglar

Áhugaverđar innlendar vefsíđur

- Áskorun til forseta Íslands

- Economic Disaster Area

- "Glæsileg niðurstaða"!

- Heimssýn

- Hagsmunasamtök heimilanna

- Hvítbókin

- Icesave-reiknir - hver skuldbindingin?

- Samningurinn við Breta vegna Icesave

- Samningurinn við Hollendinga vegna Icesave

Áhugaverđar erlendar vefsíđur

- Bloomberg

- Business Monitor International

- Do you know the truth about the EU?

- Folkebevægelsen mod EU, Danmörku

- Global Britain... in the wider world

- Institute for Creditary Economics - ICE

- Naomi Klein

- Nei til EU, Noregi

- Nej til EU, Svíþjóð

- Juni bevægelsen for et nyt og slankt EU

- RGE Monitor

- TEAM the European Alliance of EU-Critical Movements

- VOX

- World Socialist Web Site

Erlend dagblöđ og tímarit

- Aftenposten

- Al Jazeera

- Berlinske Tidende

- Dagens Nyheter

- Deutsche Welle - DW-World

- Dimmalætting

- E24

- Economist

- Financial Times

- Forbes

- Fortune

- Gulf Times

- IceNews - Daily News

- Irish Independent

- Jyllands-Posten

- Le Figaro

- Le Monde

- London Evening Standard

- Politiken

- Spectator

- Telegraph

- The Daily Princetonian

- The Huffington Post

- The Independent

- The New York Times

- The Wall Street Journal - Europe Edition

- The Washington Post

- Zeit On Line

Greinar um Ísland og kreppuna í erlendum miđlum

- Walking up to reality in Iceland, by Jón Daníelsson

- Time to install Iceland 2.0, by Ben H Murray

- Bizarre battering of insurers, by Anthony Hilton

- European bank bail-out could push EU into crisis, by Bruno Waterfield

- In praise of Iceland, editorial

- Culpability debate at RBS intensifies, by Kate Burgess

- Iceland in turmoil as coalition collapses, by David Ibison

- Iceland Turns Hard Left

- Ireland? Iceland? Doubts on Doomsday Scenario in Eire, by Landon Thomas

- Crime Once Exposed Has no Refuge but in Audacity - Tacitus, by Íris Erlingsdóttir

- Iceland's Conservatives Try to Rewrite History, by Íris Erlingsdóttir

- Cracks in the crust

- Major-Washington Agency Runs Iceland Look-Alike Casting, by Edward Hugh

- Nobel prize winner blasts IMF over loans

- How Bad Could The Crisis Get? Lessons From Iceland, Jón Daníelsson

- Iceland: The country that became a hedge fund, by Peter Gumbel

- Ultra-Capitalism Killed Iceland

- Upheaval calls for Fleece Revolution in Iceland, by Lenka Vaiglova

- Who bombed Iceland? by Uwe Reinhardt

- World Agenda: is this the most hated man in Iceland? by Roger Boyes

- Britain and the Netherlands bully little Iceland, by Ársæll Valfells

- Iceland gets cold feet over paying back bailout

- Latvian debt crisis shakes Eastern Europe, by Ambrose Evans-Pritchard

- Iceland PM hits out at IMF rumors, by K. Már Hauksson

- Britain's 'gunboat' diplomacy still angers Iceland, by Ambrose Evans-Pritchard

- A Debate Rages in Iceland: Independence vs. I.M.F. Cash, by Landon Thomas

- All Of Them Must GO, by Naomi Klein

- SFO to help Iceland as probe turns to Kaupthing's US links, by Rowena Mason

- Iceland hits impasse over lost savings, by Andrew Ward and Alex Barker

- Icelanders are angry but will make sacrifices, by Jóhanna Sigurðardóttir

- Iceland seeks UK fraud office help, by Andrew Ward

- For you, the war is over, by Andrew Hill

- Iceland poised for foreign payback pact, by Andrew Ward, Megan Murphy and Jim Pickard

- Iceland’s debt repayment limits will spread, by Michael Hudson

- Iceland: what ugly secrets are waiting to be exposed in the meltdown?, by Rowena Mason

- The ice storm, by Gauti Kristmannsson

- Brain drain hits cash-strapped Iceland, by Susanne Henn

- Islands nye krise, av Ola Storeng

- Iceland's bank crisis delivers baby boom, by Andrew Ward

- Is Iceland too small? By Þorvaldur Gylfason

- Iceland shows the dangers ahead for us all, by Robert Wade

- Islands Schulden sind zu teilen, Von Clemens Bomsdorf

- The IMF destroys Iceland and Latvia, by Nathan Lewis

- The Lehman Brothers collapse: the global fallout, by Richard Wachman

- Iceland urges media to lift nation’s gloom, by Andrew Jack

- Iceland after a year of financial crisis, by Robert Jackson

- Iceland’s PM: Icesave Will Decide the Coalition’s Fate

- Iceland’s PM: We Cannot Wait for IMF Any Longer

- Iceland Reaches Agreement with IMF

- Iceland Minister Confident Icesave Bill Will Pass

- Iceland's president turns cold on Icesave deal, by Rowena Mason

Greinar um Ísland og kreppuna í innlendum miđlum

Álit erlendra sérfrćđinga um orsakir efnahagshrunsins

- Undersized: Could Greenland be the new Iceland? Should it be?

- The Icelandic banking crisis and what to do about it: The lender of last resort theory of optimal currency areas

Greinar um hvers vegna Icesave eru ekki skuldir Íslendinga

Greinar um efnahagskreppuna í erlendum dagblöđum

Evrópusambandiđ

- Support for Lisbon Treaty falls eight points to 46%, by Stephen Collins

- The European Union the New Soviet Union, by Vladimir Bukovsky

Útvarps- og sjónvarpsţćttir á netinu

Innlendir og erlendir ljósvakamiđlar

Bloggvinir

-

malacai

malacai

-

andrigeir

andrigeir

-

arikuld

arikuld

-

axelthor

axelthor

-

baldvinj

baldvinj

-

creel

creel

-

birgitta

birgitta

-

bjarnihardar

bjarnihardar

-

gattin

gattin

-

gagnrynandi

gagnrynandi

-

draumur

draumur

-

egill

egill

-

erla

erla

-

estheranna

estheranna

-

finni

finni

-

gretarmar

gretarmar

-

tilveran-i-esb

tilveran-i-esb

-

skulablogg

skulablogg

-

bofs

bofs

-

hreinn23

hreinn23

-

morgunblogg

morgunblogg

-

maeglika

maeglika

-

helgatho

helgatho

-

hedinnb

hedinnb

-

kreppan

kreppan

-

islandsfengur

islandsfengur

-

jonl

jonl

-

kaffistofuumraedan

kaffistofuumraedan

-

capitalist

capitalist

-

katrinsnaeholm

katrinsnaeholm

-

liljaskaft

liljaskaft

-

lydurarnason

lydurarnason

-

vistarband

vistarband

-

marinogn

marinogn

-

pallvil

pallvil

-

raksig

raksig

-

raudurvettvangur

raudurvettvangur

-

rutlaskutla

rutlaskutla

-

sigurjonth

sigurjonth

-

siggi-hrellir

siggi-hrellir

-

sij

sij

-

siggith

siggith

-

fia

fia

-

lehamzdr

lehamzdr

-

isspiss

isspiss

-

tryggvigunnarhansen

tryggvigunnarhansen

-

vest1

vest1

-

kreppukallinn

kreppukallinn

-

reykur

reykur

-

thjodarsalin

thjodarsalin

-

aevark

aevark

-

isleifur

isleifur

-

thorsaari

thorsaari

-

tbs

tbs

-

eeelle

eeelle

Heimsóknir

Flettingar

- Í dag (10.9.): 0

- Sl. sólarhring:

- Sl. viku: 3

- Frá upphafi: 0

Annađ

- Innlit í dag: 0

- Innlit sl. viku: 3

- Gestir í dag: 0

- IP-tölur í dag: 0

Uppfćrt á 3 mín. fresti.

Skýringar

Bćta viđ athugasemd [Innskráning]

Ekki er lengur hćgt ađ skrifa athugasemdir viđ fćrsluna, ţar sem tímamörk á athugasemdir eru liđin.